there are endless examples of stocks doubling and more over periods of ........

2 years ........

5 years ......

i'm tellin' ya, if you look at some of these examples, you'll see ...... well, i'm not tellin' ya that, but i think this is what you'll see ....... lots, for example, that were down, and then went up fast ..........

there's always this question of risk ......... but, if you're a working person, and pick, let's say, a likely looking stock that's down ........... one every month .......... and put a hundred dollars in it ............. and then hold on for ............ even just a double .............. you'll do well

that's my advice for the working person ........... and you're entering an area of risk, here, so don't put more than $100 a month into this system ............ until you know more! ........... because the system is as described ............ in about ten words ........... or twenty, anyway .......... in poetry, no less! .......... and put the rest of your savings ............ save more! .............. save, save, save! ......... into some other system ............. like an index fund

but, i will also say this

if you want to be systematic about

research

you can go to finviz.com

run a scan with no criteria

and get a list of 7000 stocks

and then you can look at

a history of each stock

which is called a chart

looking at 7000 charts

will take you a year

but if you look at monthly charts

what you're looking for is a stock

that recently doubled

in one month

so the month's low will be, say, $5

one month

and the month's high

that same month

was $10

what you're seeing

when you see that

is exceptional performance

so, what was happening

just before that terrific month?

how do you even talk about that?

sooooooo ....

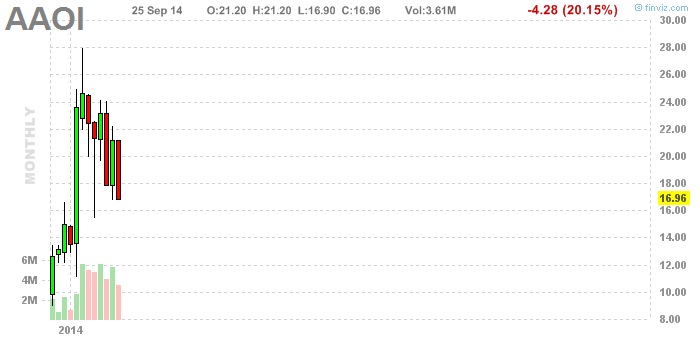

i looked at

i would say

a half dozen charts

and then i found one

that doubled

in a month

in 2014

a new issue

i think that's what it means

that there's very little history

and i've been noticing

i think

that new issues are volatile

(so i guess that's why they're

something to think about)

sometime in February

presumably at the beginning of February

aaoi traded under $12 a share

and

presumeably later in February

it traded at $24

it doubled in February

there's no long term pattern to look at

this is the daily chart

is there something in this chart that's worth noting? it was a new issue thus, with the potential to be volatile probably already a decent size company because finviz stocks all trade actively and then it went down for a month in several little steps down in several little steps down in several little steps question number 1: a hint? a clue? question number 2: do you think this says it all?